Reverse Sales Tax Calculator

Quickly find the original price and tax amount from any total purchase price.How Reverse Sales Tax Calculator Works

This calculator works both ways to help you understand the relationship between prices and sales tax. You can either start with a total price (including tax) and work backwards to find the original price, or start with the original price and calculate what the total will be after tax is added.

When you're converting from gross to net (the most common scenario), you're essentially removing the tax from a total price you've already paid. This is helpful when you need to know how much you actually paid for the item versus how much went to taxes - useful for expense reports, accounting, or just understanding your purchases better.

The net to gross conversion works the opposite way, showing you what a pre-tax price will cost after sales tax is added. This is handy for budgeting when you know the sticker price but need to plan for the total out-of-pocket cost.

Both calculations automatically show you exactly how much money went to taxes, which is especially valuable for business expenses, tax deductions, or when you need to separate the taxable portion from the tax itself.

Reverse Sales Tax Calculator Formula Breakdown

Formula

For gross to net (removing tax): Net price = Gross price ÷ (1 + Tax rate)

For net to gross (adding tax): Gross price = Net price × (1 + Tax rate)

Tax amount = |Gross price - Net price|Variables Explained

- PriceThe starting amount for your calculation. This could be either the total price you paid (including tax) or the original sticker price (before tax), depending on which conversion you're doing. Enter this as the dollar amount without the currency symbol.

- Tax rateThe sales tax percentage applied to the purchase. This varies by location and can include state, county, and city taxes combined. You can find this rate on your receipt, or look up your local tax rate online. Enter as a percentage (like 8.5 for 8.5%).

- Conversion typeChoose whether you're starting with the total price and want to find the original price (gross to net), or starting with the original price and want to find the total after tax (net to gross).

Example Calculation

Given:

- Price: $110.00

- Tax rate: 10%

- Conversion type: Gross to net

Calculation:

Tax rate as decimal: 10% ÷ 100 = 0.10

Net price: $110.00 ÷ (1 + 0.10) = $110.00 ÷ 1.10 = $100.00

Tax amount: $110.00 - $100.00 = $10.00Result:

$100.00Explanation

This example shows someone who paid $110 total for an item in an area with 10% sales tax. The calculation reveals that the original item price was $100, and $10 went to taxes.

Tips for Using Reverse Sales Tax Calculator

- 💡Double-check your local tax rate since it often includes multiple layers (state + county + city). Using an outdated or incomplete rate will throw off your calculations.

- 💡Keep receipts that show both the pre-tax and total amounts to verify your calculations and ensure you're using the right conversion direction.

- 💡For business expenses, knowing the exact tax amount helps with bookkeeping since you may need to report taxable purchases separately from the tax itself.

Make Your Own Web Calculator in 3 Simple Steps

Create Interactive Calculator

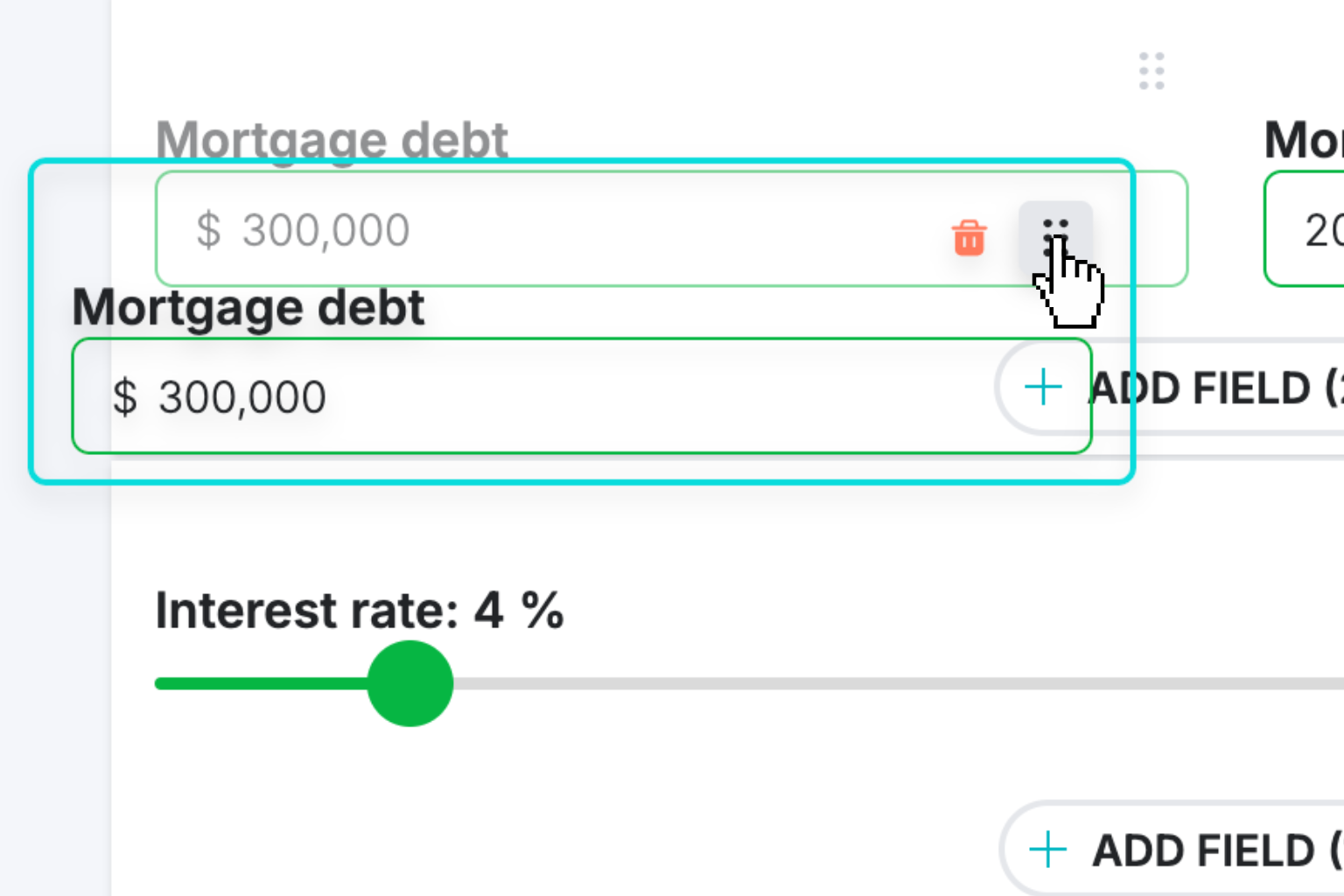

Design your interactive calculator in under 5 minutes using our drag-and-drop builder.Preview & Generate Embed Code

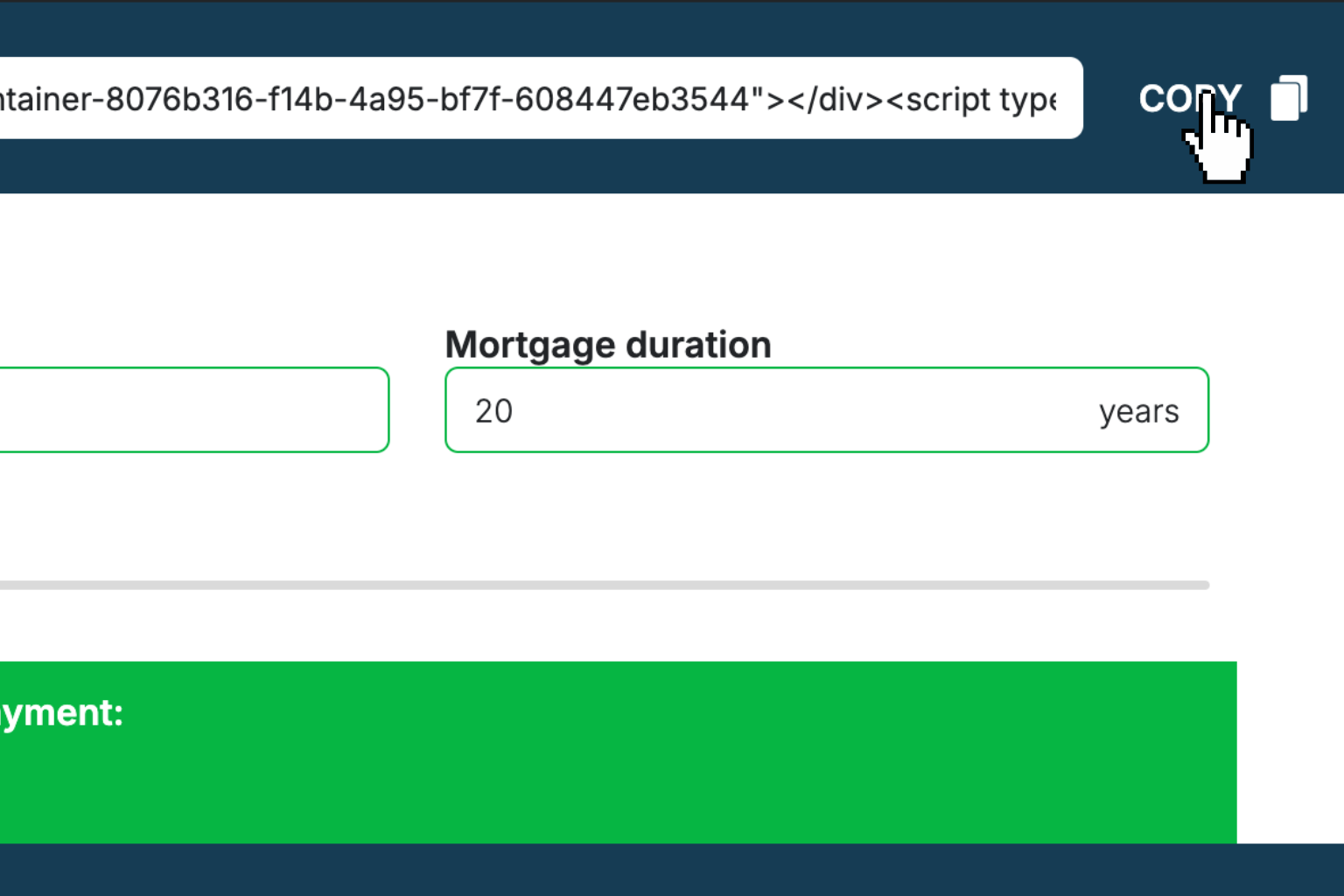

Review your calculator and copy the embed script when you're satisfied with the results.Embed Calculator Into Your Website

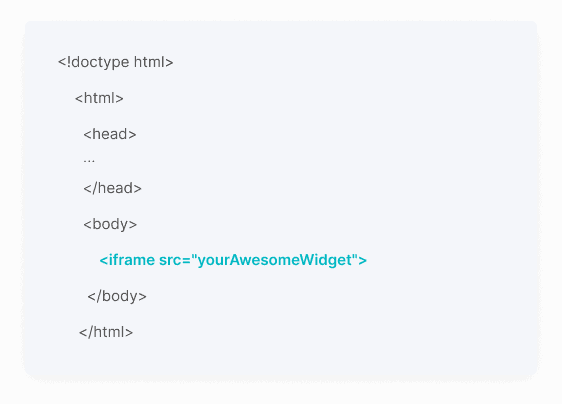

Paste the code into your website's HTML. Works on WordPress, Shopify, Wix, and any platform. EugenCreator of Creative Widgets

EugenCreator of Creative Widgets“After 10+ years in digital marketing, I’ve built calculators that drove thousands of new leads for clients. I realized one thing: calculators convert. They're killer for CRO and great for SEO. That's why I built Creative Widgets—an easy, no-code calculator builder. ”

It's free. Try it out. You'll like it.