Constant Growth Model Calculator

Calculate a stock's intrinsic value based on its expected future dividends and growth rate.How Constant Growth Model Calculator Works

The Constant Growth Model, also known as the Gordon Growth Model or Dividend Discount Model (DDM), estimates what a stock should be worth based on its expected future dividend payments. It's particularly useful for valuing mature companies that pay regular dividends and have predictable growth patterns.

This model works on the principle that a stock's value equals the present value of all future dividends it will pay. By factoring in the expected dividend amount, how fast those dividends will grow over time, and your required rate of return, you can determine if a stock is fairly priced, overvalued, or undervalued compared to its current market price.

The calculation assumes dividends will grow at a steady rate forever, which makes it most accurate for stable, mature companies in established industries. It's commonly used by investors and analysts to make buy/sell decisions and compare investment opportunities across different dividend-paying stocks.

Constant Growth Model Calculator Formula Breakdown

Formula

Current market price = Expected dividend ÷ (Required return rate - Current growth rate)Variables Explained

- Expected dividendThe annual dividend per share you expect the company to pay next year, typically based on the most recent dividend payment adjusted for expected growth. This information can be found in company financial statements, investor relations materials, or financial data platforms.

- Current growth rateThe annual percentage rate at which the company's dividends are expected to grow indefinitely. This is often estimated by analyzing the company's historical dividend growth pattern over the past 5-10 years or using analyst forecasts.

- Required return rateThe minimum annual return rate you require to invest in this stock, reflecting the investment's risk level. This is typically higher than risk-free rates (like Treasury bonds) and can be estimated using models like CAPM or based on your personal investment criteria and the company's risk profile.

Example Calculation

Given:

- Expected dividend: $100

- Current growth rate: 3%

- Required return rate: 8%

Calculation:

Market price = $100 ÷ (8% - 3%)

Market price = $100 ÷ 5%

Market price = $100 ÷ 0.05 = $2,000Result:

$2,000.00Explanation

This example shows a stock that pays $100 per share in annual dividends, with dividends expected to grow at 3% per year. Given an 8% required return rate, the model suggests the stock's fair value is $2,000 per share.

Tips for Using Constant Growth Model Calculator

- 💡Ensure the growth rate is lower than the required return rate, otherwise the model will produce unrealistic results or negative stock prices.

- 💡Use historical dividend data spanning at least 5-10 years to estimate a realistic growth rate, and consider industry trends and company fundamentals when making projections.

- 💡Remember this model assumes constant growth forever, which is unrealistic for most companies, so use it alongside other valuation methods for a complete investment analysis.

Make Your Own Web Calculator in 3 Simple Steps

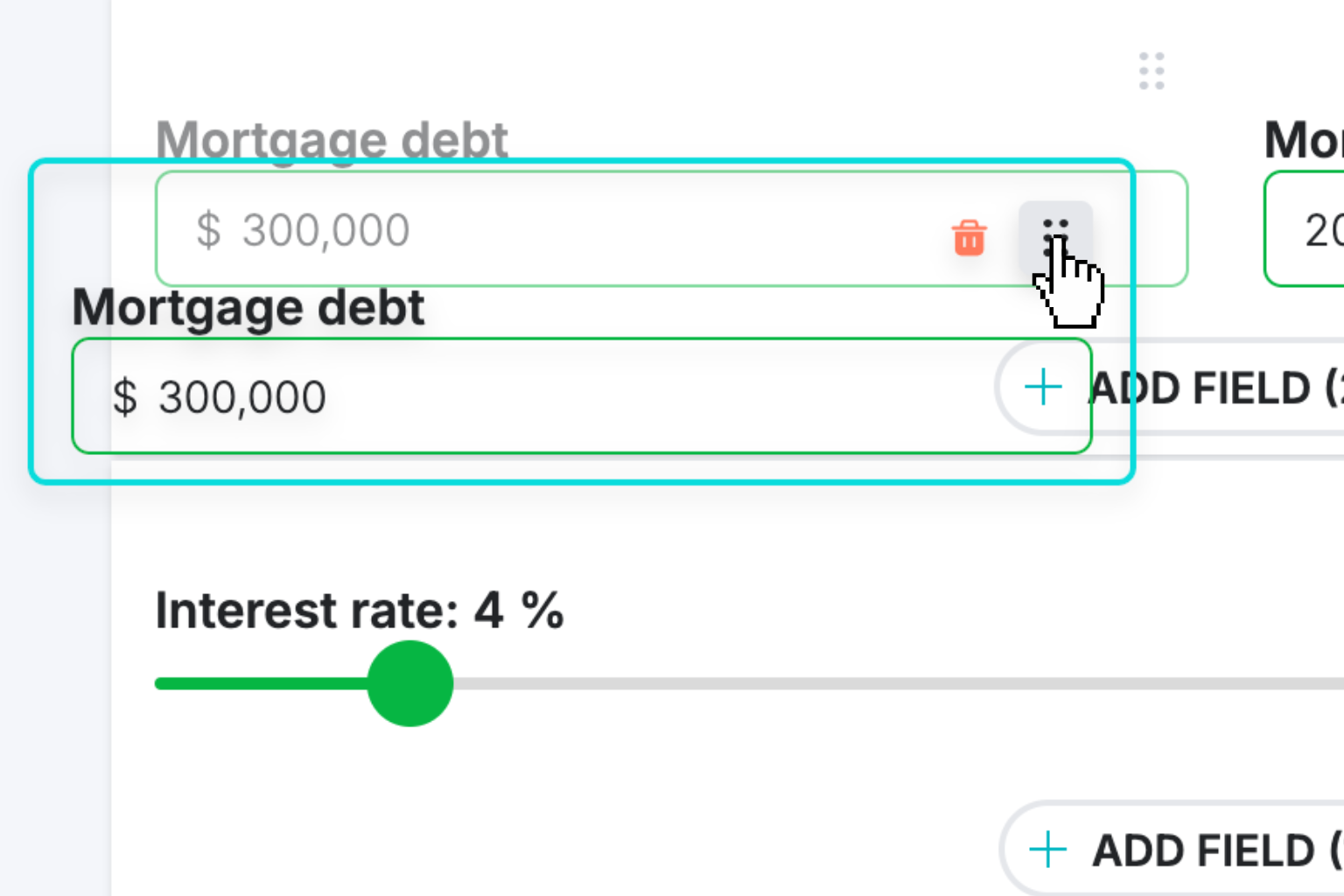

Create Interactive Calculator

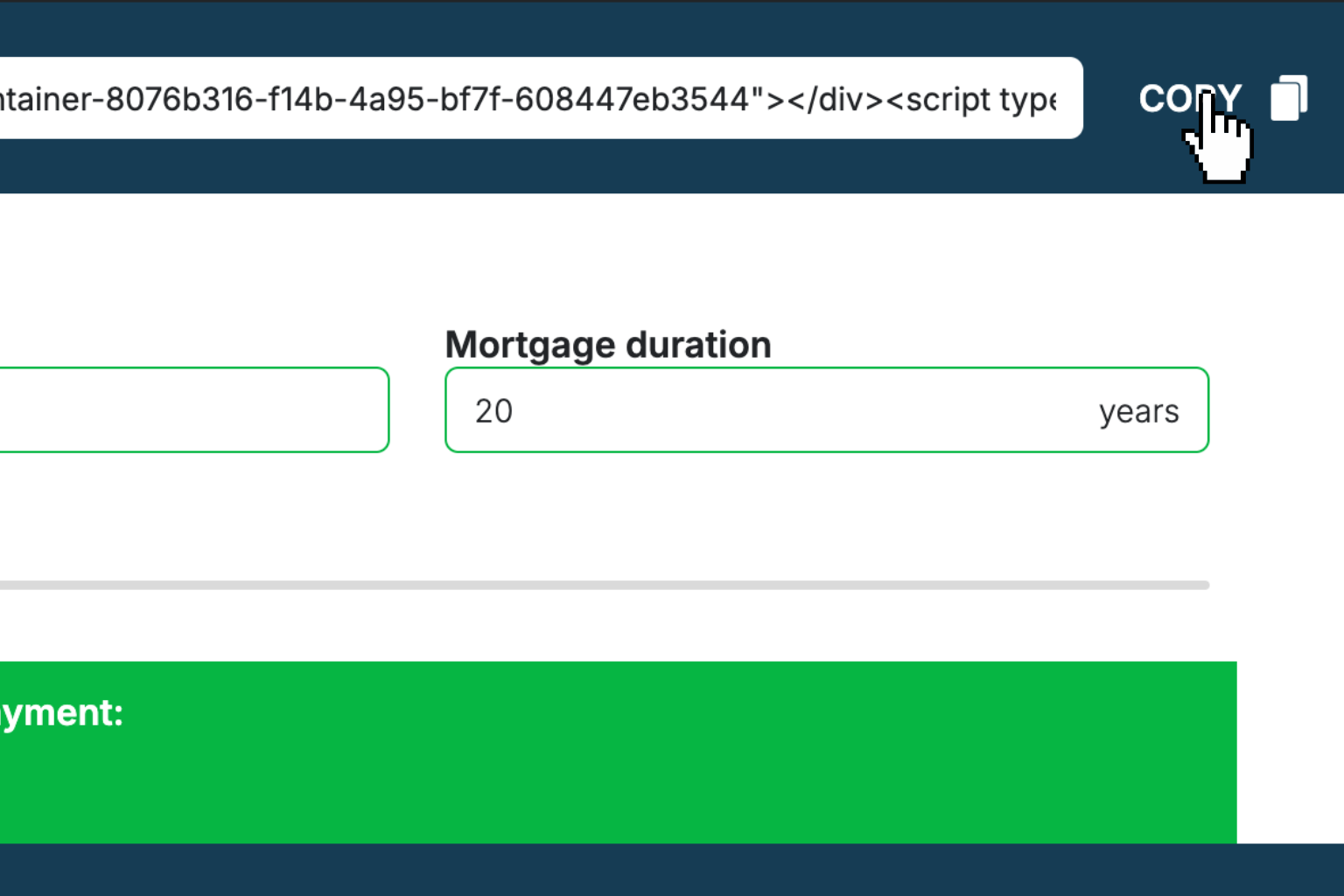

Design your interactive calculator in under 5 minutes using our drag-and-drop builder.Preview & Generate Embed Code

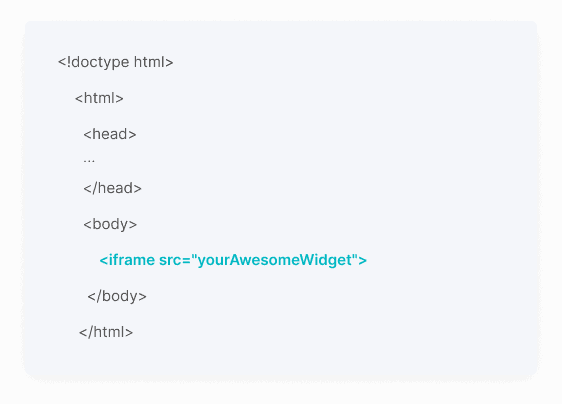

Review your calculator and copy the embed script when you're satisfied with the results.Embed Calculator Into Your Website

Paste the code into your website's HTML. Works on WordPress, Shopify, Wix, and any platform.

Eugen

Creator of Creative Widgets“After 10+ years in digital marketing, I’ve built calculators that drove thousands of new leads for clients. I realized one thing: calculators convert. They're killer for CRO and great for SEO. That's why I built Creative Widgets—an easy, no-code calculator builder. ”

It's free. Try it out. You'll like it.