Net Operating Profit After Tax (NOPAT) Calculator

Calculate your company's true operating profit after taxes without the effects of debt or financing decisions.How Net Operating Profit After Tax (NOPAT) Calculator Works

NOPAT (Net Operating Profit After Tax) measures your company's operational performance by showing how much profit you'd keep from core business activities after paying taxes, but without considering any debt-related tax savings. Think of it as your 'pure' operating performance metric.

The calculation starts with your operating income (also called EBIT), which represents profit from your main business operations before interest and taxes. This includes revenue minus all operating costs like cost of goods sold, salaries, rent, and other day-to-day expenses.

From there, you apply your effective tax rate to see how much you'd pay in taxes on that operating income, assuming you had no debt. This gives you a clear picture of operational efficiency that's not influenced by financing decisions.

NOPAT is particularly useful for comparing companies with different capital structures or when evaluating potential acquisitions, since it strips away the effects of leverage and focuses purely on how well management runs the core business.

Net Operating Profit After Tax (NOPAT) Calculator Formula Breakdown

Formula

Operating income = Revenue - Cost of goods sold - Operating expenses (SG&A, depreciation, etc.)

NOPAT = Operating income × (1 - Tax rate)Variables Explained

- RevenueTotal income generated from your primary business operations before any expenses. This includes sales of products or services but excludes one-time gains or investment income. Found at the top of your income statement.

- Cost Of Goods Sold (COGS)Direct costs of producing or purchasing the goods you sell, including materials, labor, and manufacturing overhead. For service businesses, this might include direct labor costs. Found on your income statement below revenue.

- Selling, General, and Administrative Expenses (SG&A)Indirect operating expenses like salaries, rent, marketing, utilities, and office supplies that aren't directly tied to production. These are ongoing costs of running your business, excluding interest and taxes.

- Depreciation and AmortizationThe portion of long-term asset costs (equipment, buildings, intangible assets) allocated to the current period. This non-cash expense reflects how your assets lose value over time and is found in your operating expenses section.

- Effective Tax RateThe percentage of operating income you actually pay in taxes, calculated from your historical tax payments or current tax situation. Use your company's actual tax rate rather than the statutory rate for more accuracy.

Example Calculation

Given:

- Revenue: $500,000

- Cost Of Goods Sold (COGS): $200,000

- Selling, General, and Administrative Expenses (SG&A): $100,000

- Depreciation and Amortization: $50,000

- Effective Tax Rate: 30%

Calculation:

Operating income = $500,000 - $200,000 - $100,000 - $50,000 = $150,000

NOPAT = $150,000 × (1 - 0.30) = $150,000 × 0.70 = $105,000Result:

$105,000Explanation

This example shows a small manufacturing company with $500,000 in annual revenue. After covering all operating costs, they generate $150,000 in operating income. Their NOPAT of $105,000 represents the after-tax profit available from core operations, giving investors a clear view of operational performance independent of any debt financing.

Tips for Using Net Operating Profit After Tax (NOPAT) Calculator

- 💡Use your company's actual effective tax rate rather than the statutory rate for more accurate results, as most businesses don't pay the full corporate tax rate due to deductions and credits.

- 💡Exclude one-time gains, losses, or unusual expenses from your operating income calculation to get a clearer picture of ongoing operational performance.

- 💡Compare your NOPAT margin (NOPAT ÷ Revenue) to industry peers to benchmark your operational efficiency, since this metric neutralizes differences in capital structure.

Make Your Own Web Calculator in 3 Simple Steps

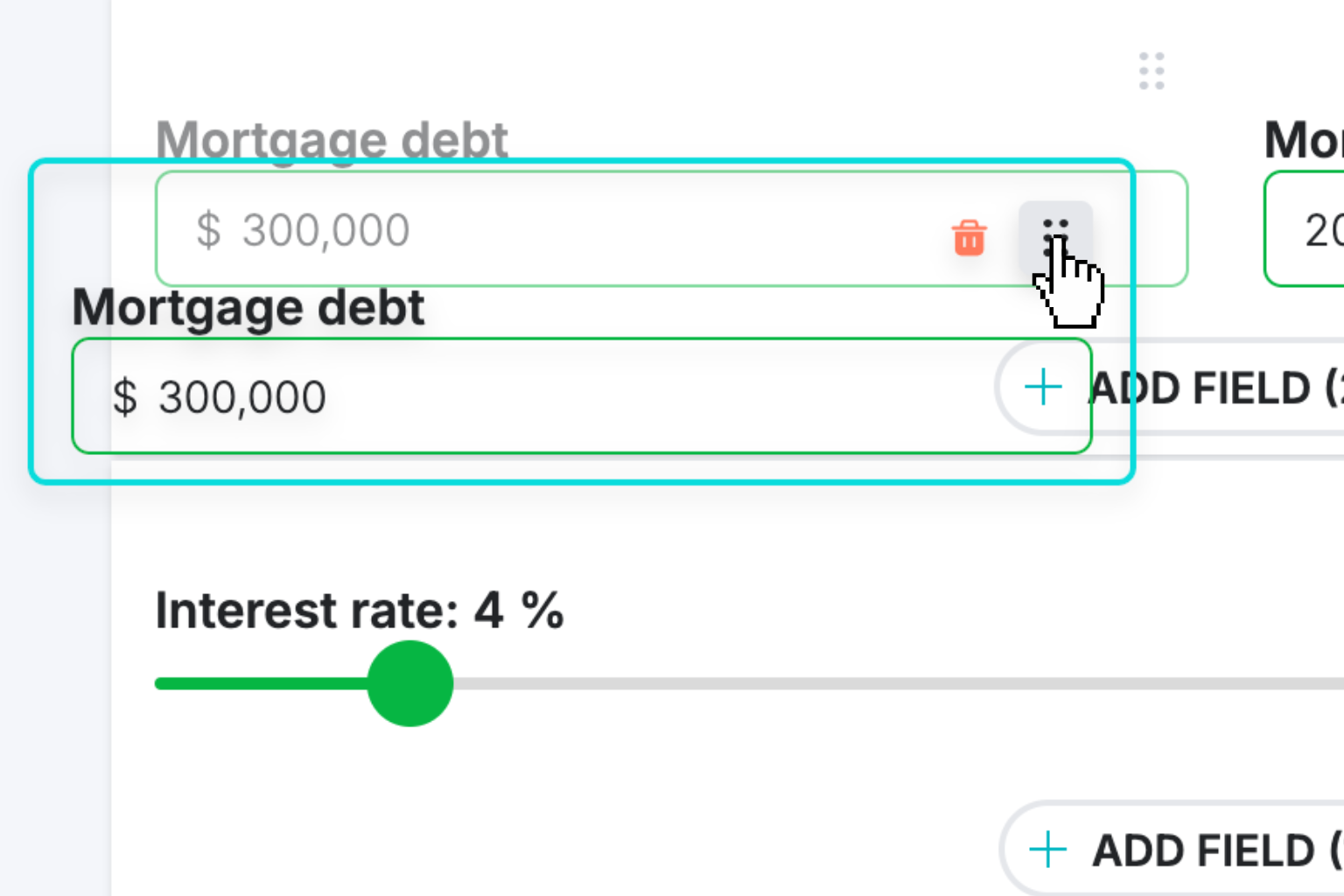

Create Interactive Calculator

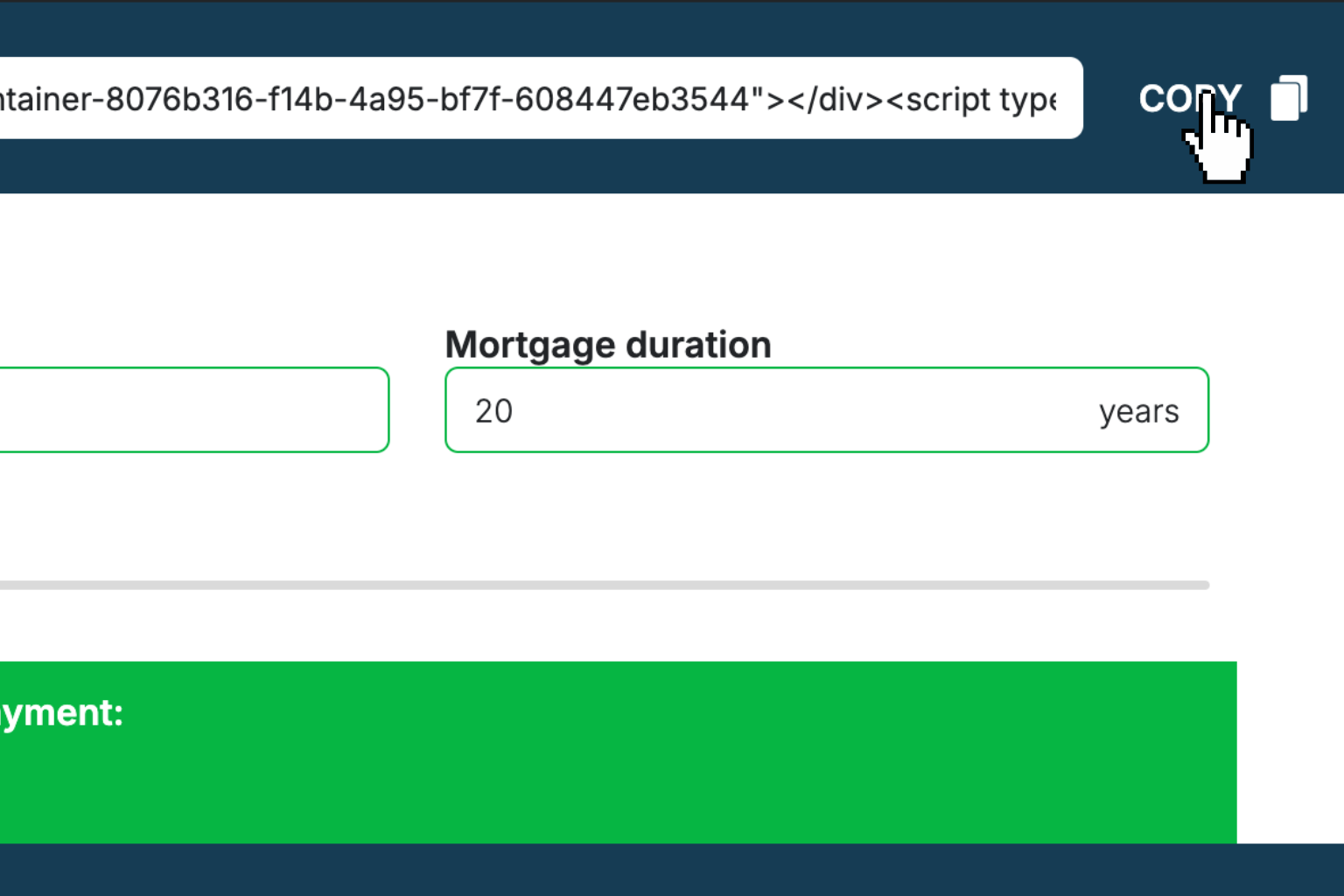

Design your interactive calculator in under 5 minutes using our drag-and-drop builder.Preview & Generate Embed Code

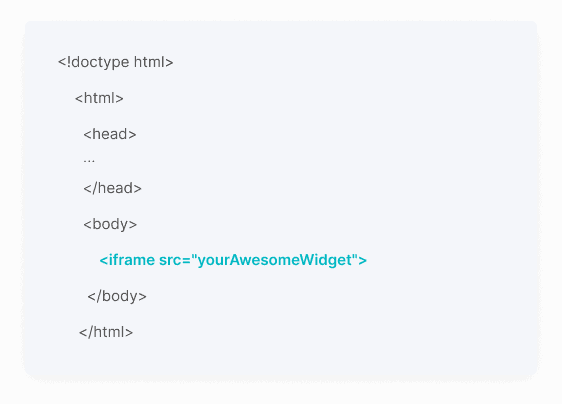

Review your calculator and copy the embed script when you're satisfied with the results.Embed Calculator Into Your Website

Paste the code into your website's HTML. Works on WordPress, Shopify, Wix, and any platform. EugenCreator of Creative Widgets

EugenCreator of Creative Widgets“After 10+ years in digital marketing, I’ve built calculators that drove thousands of new leads for clients. I realized one thing: calculators convert. They're killer for CRO and great for SEO. That's why I built Creative Widgets—an easy, no-code calculator builder. ”

It's free. Try it out. You'll like it.