Holding Period Return Calculator

Calculate your total investment returns including dividends with our simple holding period return calculator.How Holding Period Return Calculator Works

A holding period return (HPR) calculator helps you determine the total return on an investment over any time period – whether you held it for days, months, or years. It captures both capital gains (how much the stock price changed) and dividend income in one comprehensive percentage.

The calculator works by comparing your ending value to your initial investment, then adding any dividend income you received along the way. This gives you the full picture of your investment performance, not just the stock price movement. Many investors overlook dividend income when evaluating returns, which can significantly underestimate actual performance.

You'll find this calculation particularly useful when comparing different investments that you held for varying time periods, or when you want to see how dividend-paying stocks stack up against growth stocks. The calculator can also show you the dividend yield separately, helping you understand how much of your return came from income versus price appreciation.

Holding Period Return Calculator Formula Breakdown

Formula

Total holding period return = (Ending value - Initial value + Dividend income) ÷ Initial value × 100

Dividend yield = (Dividend income ÷ Initial value) × 100Variables Explained

- Initial ValueThe total amount you originally paid to purchase the investment, including any fees or commissions. This is your cost basis for tax purposes and the starting point for calculating returns.

- Ending ValueThe current market value of your investment or the price you sold it for. Use the most recent closing price for ongoing investments, or the actual sale price if you've already sold.

- Dividend IncomeThe total amount of dividends, interest, or other distributions you received while holding the investment. Include all cash payments but exclude reinvested dividends that increased your share count.

Example Calculation

Given:

- Initial Value: $100,000

- Ending Value: $120,000

- Dividend Income: $0

Calculation:

Capital appreciation: $120,000 - $100,000 = $20,000

Total return: $20,000 + $0 = $20,000

Holding period return: ($20,000 ÷ $100,000) × 100 = 20.00%Result:

20.00%Explanation

This example shows a stock investment that grew from $100,000 to $120,000 with no dividend payments, resulting in a 20% total return from capital appreciation alone.

Tips for Using Holding Period Return Calculator

- 💡Include all dividend payments received during your holding period, even small quarterly payments, as they can significantly impact your total return calculation.

- 💡Use the actual purchase price including fees and commissions as your initial value to get accurate return calculations for tax and performance evaluation purposes.

- 💡For ongoing investments, use the most recent closing price as your ending value rather than intraday prices to ensure consistency with standard market valuations.

Make Your Own Web Calculator in 3 Simple Steps

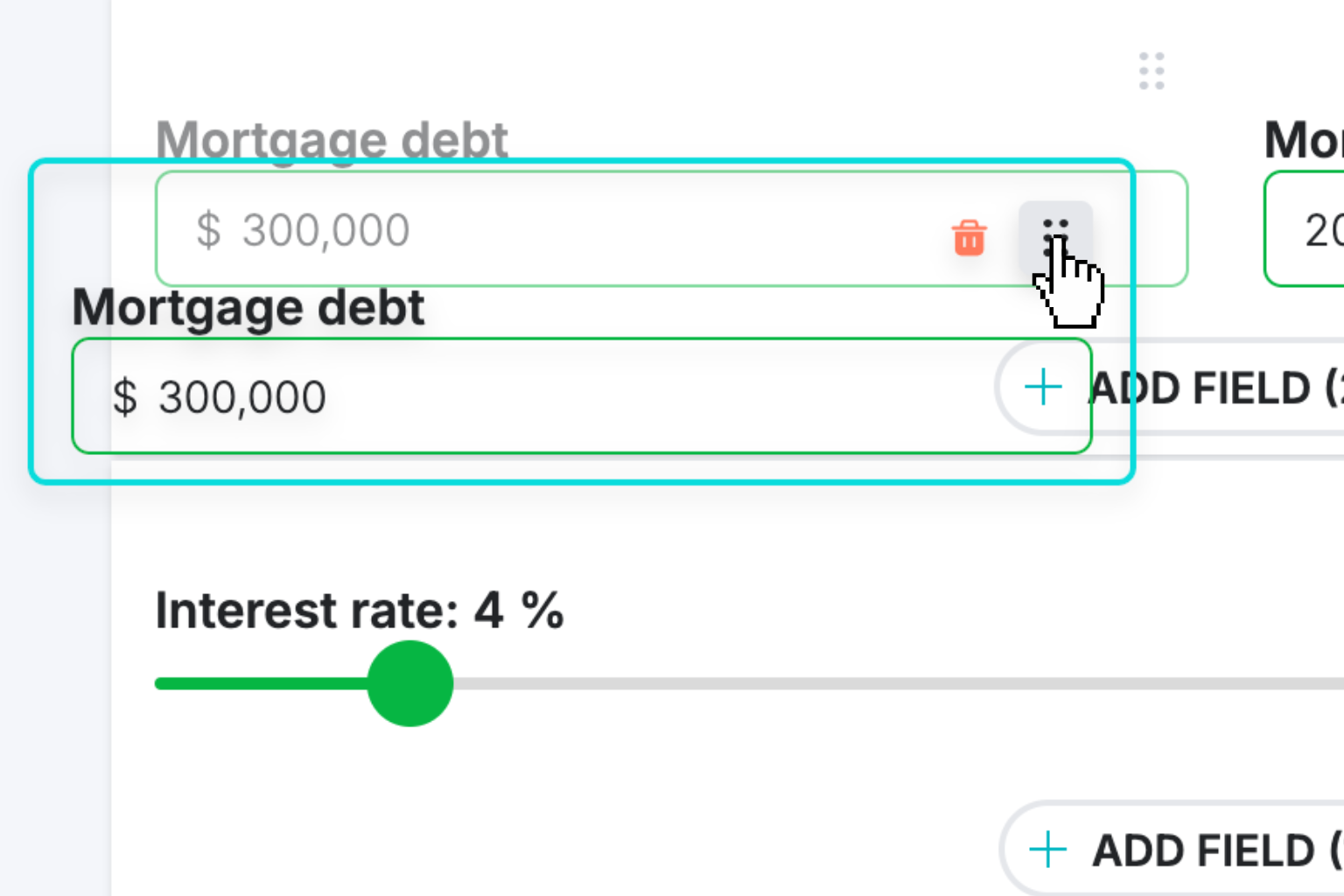

Create Interactive Calculator

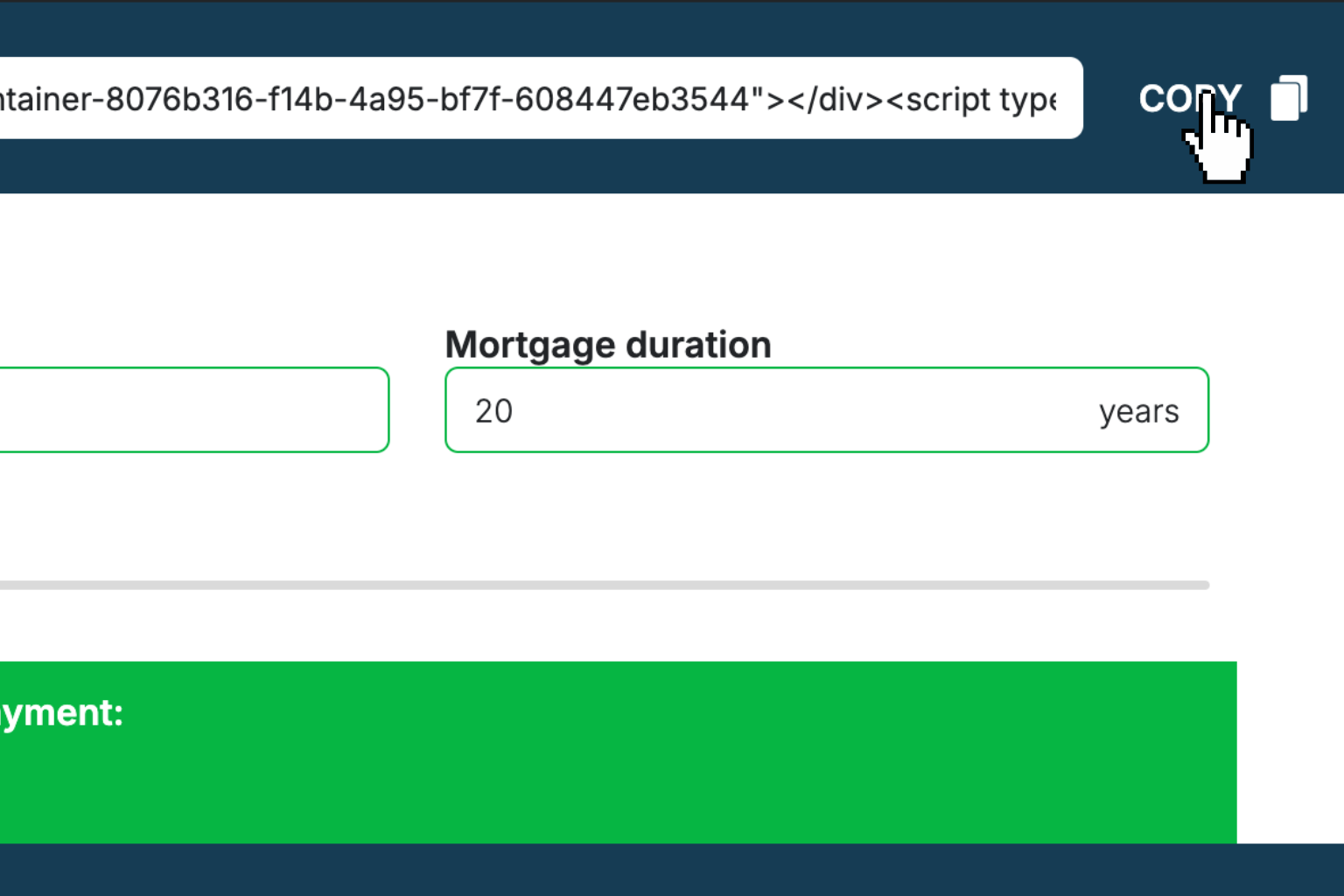

Design your interactive calculator in under 5 minutes using our drag-and-drop builder.Preview & Generate Embed Code

Review your calculator and copy the embed script when you're satisfied with the results.Embed Calculator Into Your Website

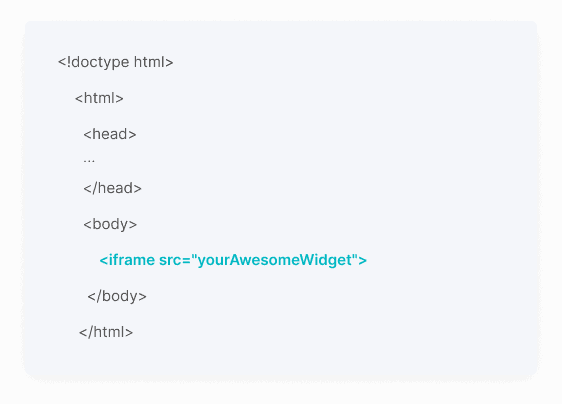

Paste the code into your website's HTML. Works on WordPress, Shopify, Wix, and any platform.

Eugen

Creator of Creative Widgets“After 10+ years in digital marketing, I’ve built calculators that drove thousands of new leads for clients. I realized one thing: calculators convert. They're killer for CRO and great for SEO. That's why I built Creative Widgets—an easy, no-code calculator builder. ”

It's free. Try it out. You'll like it.