Free Cash Flow Calculator

Quickly calculate your company's free cash flow to see how much cash is left after expenses and investments.How Free Cash Flow Calculator Works

Free cash flow shows how much cash your business generates after paying all operating expenses and capital expenditures. It's the money left over that you can use for growth, dividends, debt reduction, or other strategic initiatives.

The calculation starts with your operating cash flow—the cash generated from day-to-day business operations. Then you subtract capital expenditures, which are investments in equipment, buildings, and other long-term assets needed to maintain or expand your business.

Two optional metrics help you evaluate your cash flow performance. Free cash flow yield compares your free cash flow to your company's market value, showing how efficiently you generate cash relative to your valuation. Free cash flow per share divides your total free cash flow by outstanding shares, useful for comparing performance across companies of different sizes.

Positive free cash flow indicates strong financial health and operational efficiency. It means you're not only profitable but also converting those profits into actual cash that can fuel future growth or reward investors.

Free Cash Flow Calculator Formula Breakdown

Formula

Free cash flow = Operating cash flow - Capital expendituresVariables Explained

- Operating cash flowThe cash your business generates from its core operations, including revenue collection and operating expense payments. This figure comes directly from your cash flow statement and represents actual cash movements, not accounting profits.

- Capital expendituresMoney spent on long-term assets like equipment, buildings, technology, or other investments needed to maintain or grow your business. Also called CapEx, this information is typically found in your cash flow statement under investing activities.

- Market or enterprise valueYour company's total market capitalization or enterprise value, used to calculate free cash flow yield. For public companies, this is share price multiplied by outstanding shares. For private companies, use recent valuation estimates.

- Number of outstanding sharesTotal shares of stock currently held by investors, used to calculate free cash flow per share. This figure is found on your balance sheet or recent SEC filings for public companies.

Example Calculation

Given:

- Operating cash flow: $500,000

- Capital expenditures: $200,000

Calculation:

Free cash flow = $500,000 - $200,000 = $300,000Result:

$300,000Explanation

This example shows a healthy manufacturing company that generated $500,000 from operations and invested $200,000 in new equipment. The resulting $300,000 free cash flow provides flexibility for debt payments, dividends, or additional growth investments.

Tips for Using Free Cash Flow Calculator

- 💡Use annual figures for more accurate trends since quarterly cash flows can be volatile due to seasonal business patterns and timing of large expenditures.

- 💡Compare your free cash flow to industry peers rather than companies in different sectors, as capital intensity varies significantly between industries like software versus manufacturing.

- 💡Track free cash flow trends over 3-5 years to identify patterns—consistent growth indicates strong business fundamentals, while declining trends may signal operational challenges or market pressures.

Make Your Own Web Calculator in 3 Simple Steps

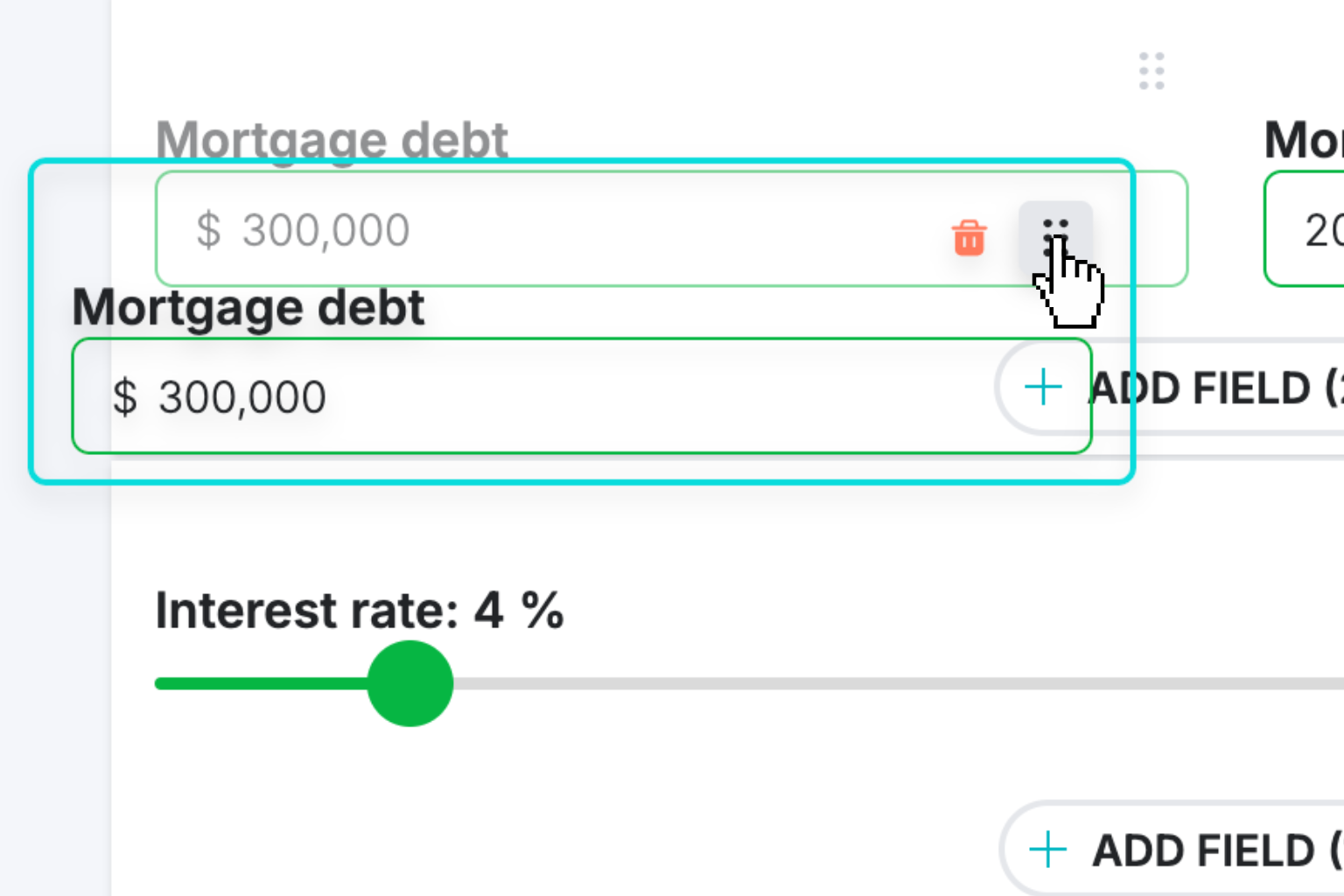

Create Interactive Calculator

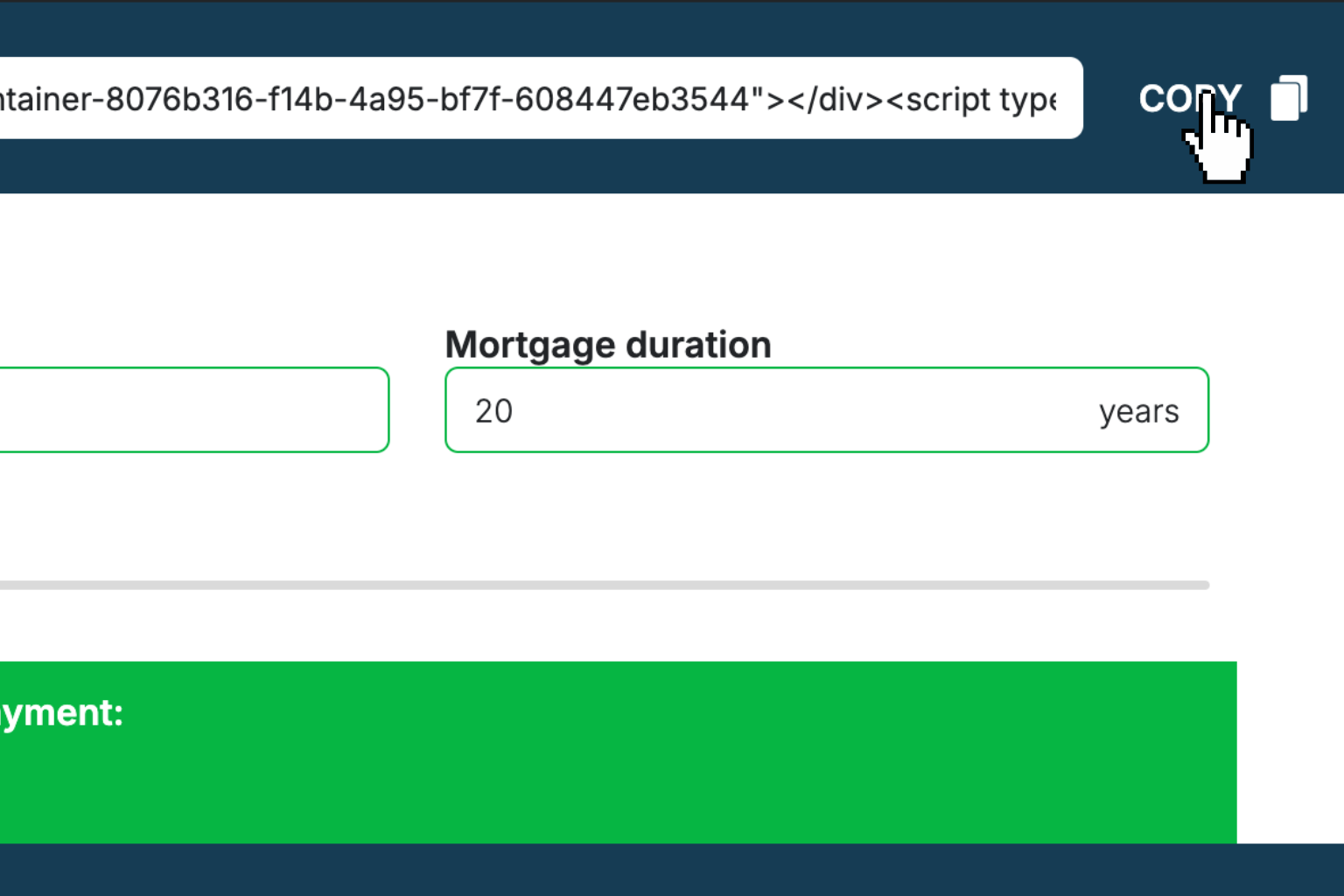

Design your interactive calculator in under 5 minutes using our drag-and-drop builder.Preview & Generate Embed Code

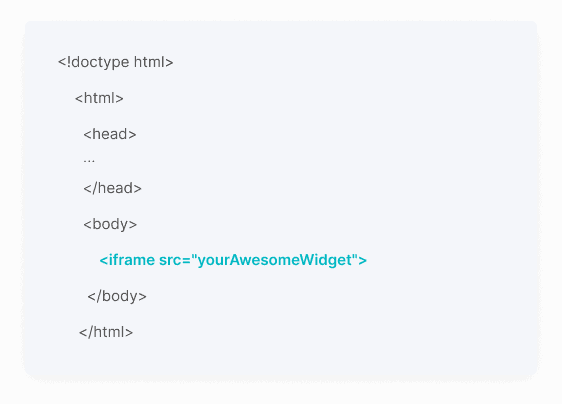

Review your calculator and copy the embed script when you're satisfied with the results.Embed Calculator Into Your Website

Paste the code into your website's HTML. Works on WordPress, Shopify, Wix, and any platform.

Eugen

Creator of Creative Widgets“After 10+ years in digital marketing, I’ve built calculators that drove thousands of new leads for clients. I realized one thing: calculators convert. They're killer for CRO and great for SEO. That's why I built Creative Widgets—an easy, no-code calculator builder. ”

It's free. Try it out. You'll like it.