After-Tax Cost of Debt Calculator

Quickly calculate your company's true borrowing cost after tax savings from interest deductions.How After-Tax Cost of Debt Calculator Works

The after-tax cost of debt calculator shows the real borrowing expense your company faces after accounting for tax benefits. Since interest payments are tax-deductible, they reduce your taxable income and lower your tax bill, making debt cheaper than its stated interest rate.

This calculation is crucial for strategic financial planning and capital structure decisions. Companies use it to compare the cost of debt financing versus equity financing, evaluate investment opportunities, and optimize their borrowing strategy.

The calculator works by first determining your marginal tax rate from your income figures, then applying the standard after-tax cost formula. Your marginal tax rate shows the percentage of tax savings you get from each dollar of interest expense.

This metric is especially valuable for CFOs and financial analysts who need to understand the true cost of capital when making financing decisions or calculating weighted average cost of capital (WACC).

After-Tax Cost of Debt Calculator Formula Breakdown

Formula

Marginal tax rate = (1 - Net income ÷ Pre-tax income) × 100

After-tax cost of debt = Cost of debt (pre-tax) × (1 - Marginal tax rate ÷ 100)Variables Explained

- Net IncomeYour company's profit after all expenses and taxes, found on the income statement. This represents what's left for shareholders after paying all obligations including income taxes.

- Pre-tax IncomeYour company's earnings before income taxes are deducted, also called earnings before tax (EBT). Found on the income statement right above the tax expense line.

- Cost of debt (pre-tax)The average annual interest rate you pay on all company debt before considering tax benefits. Calculate this by dividing total annual interest expense by average debt balance, or use the weighted average rate across all loans and bonds.

Example Calculation

Given:

- Net Income: $800,000

- Pre-tax Income: $1,000,000

- Cost of debt (pre-tax): 8%

Calculation:

Marginal tax rate: (1 - $800,000 ÷ $1,000,000) × 100 = 20.00%

After-tax cost of debt: 8% × (1 - 20.00% ÷ 100) = 6.40%Result:

6.40%Explanation

This example shows a profitable company with a 20% marginal tax rate. While they pay 8% interest on their debt, tax deductions reduce the effective cost to just 6.4%, making debt financing significantly cheaper than equity alternatives.

Tips for Using After-Tax Cost of Debt Calculator

- 💡Use your most recent annual financial statements for accuracy, as tax rates can vary significantly based on your company's profitability and tax planning strategies.

- 💡Remember that this calculation assumes you have sufficient taxable income to fully utilize the interest deduction – companies with losses may not benefit from the tax shield.

- 💡Consider both federal and state corporate tax rates when determining your marginal rate, as combined rates can reach 25-30% in high-tax states like California or New York.

Make Your Own Web Calculator in 3 Simple Steps

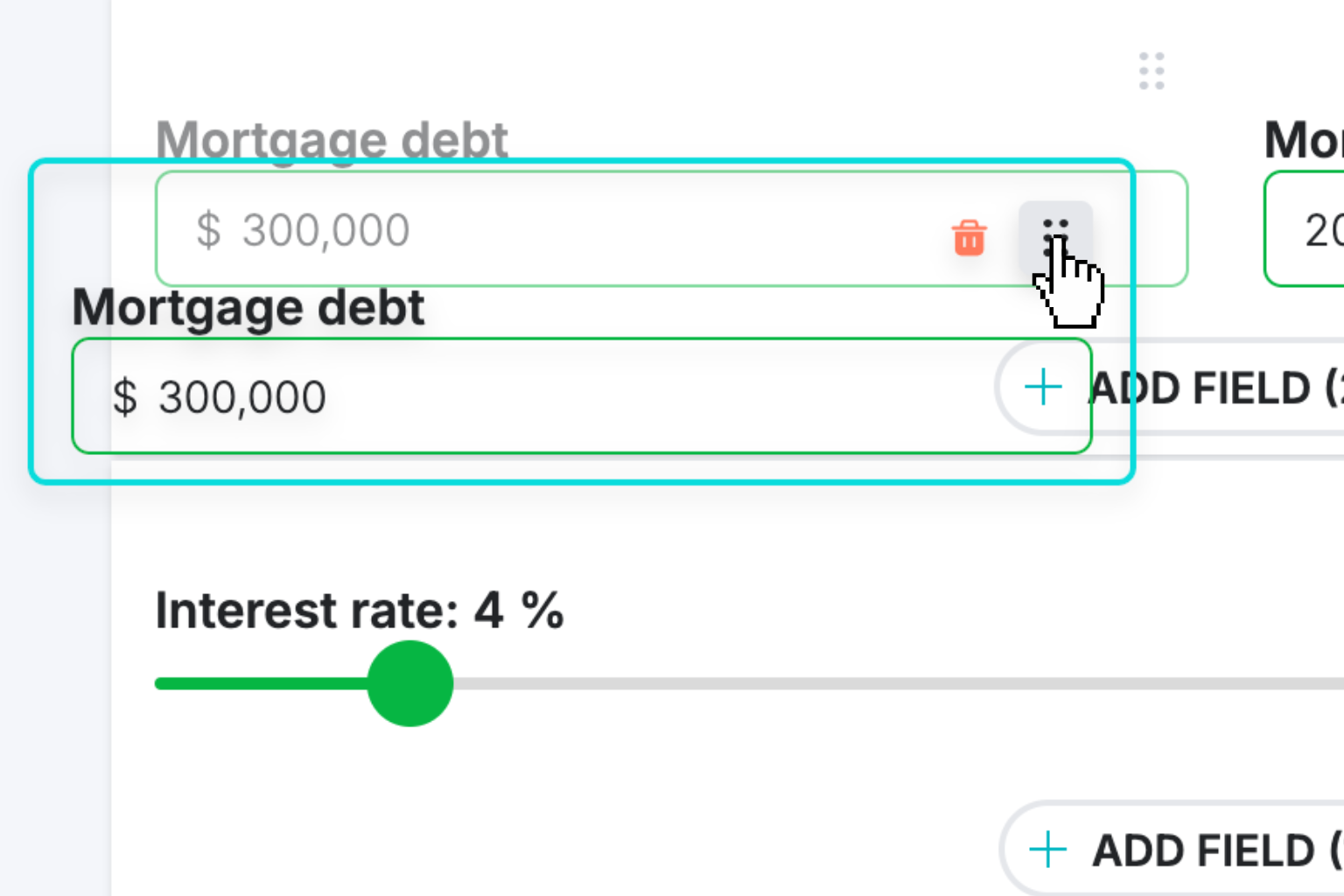

Create Interactive Calculator

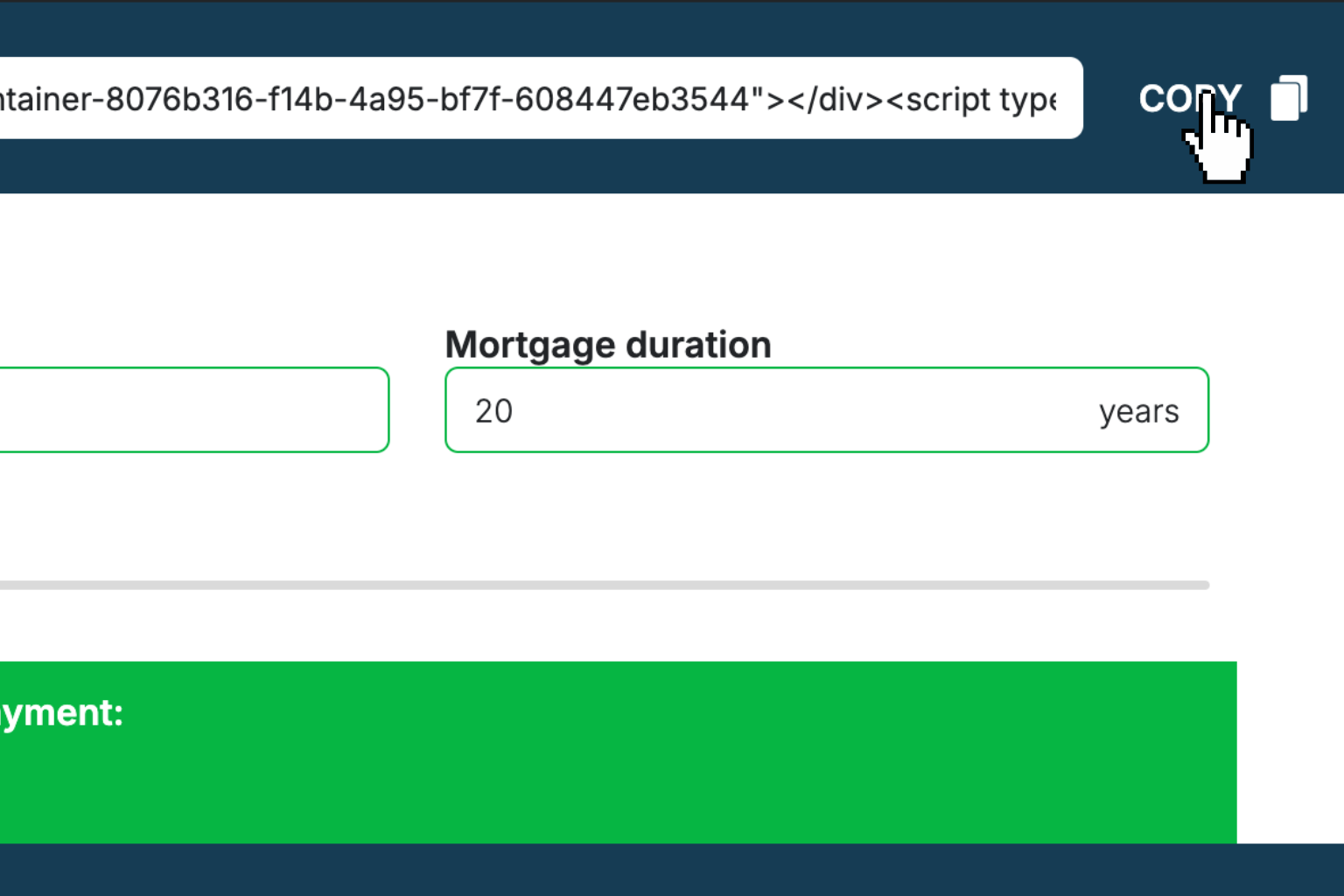

Design your interactive calculator in under 5 minutes using our drag-and-drop builder.Preview & Generate Embed Code

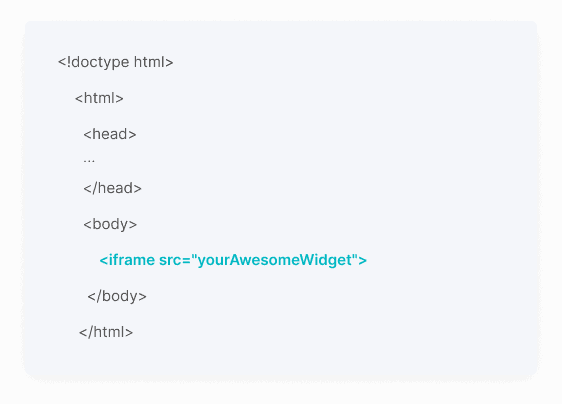

Review your calculator and copy the embed script when you're satisfied with the results.Embed Calculator Into Your Website

Paste the code into your website's HTML. Works on WordPress, Shopify, Wix, and any platform. EugenCreator of Creative Widgets

EugenCreator of Creative Widgets“After 10+ years in digital marketing, I’ve built calculators that drove thousands of new leads for clients. I realized one thing: calculators convert. They're killer for CRO and great for SEO. That's why I built Creative Widgets—an easy, no-code calculator builder. ”

It's free. Try it out. You'll like it.